Your credit score is more than just a number – it’s a reflection of your financial health. Whether you’re planning to buy a new car, apply for a mortgage, or even open a credit card, your credit score plays a crucial role in determining your financial options. You can check a Quick Guide to Obtaining All 3 Scores in 90 Seconds here.

Staying updated on your credit scores is as important as ever. In this blog post, we’ll walk you through a simple, four-step process that allows you to access all three of your credit scores and credit reports within just 90 seconds.

Step 1: Choose a Trusted Platform

The first step in checking your 2023 credit scores is selecting a reliable and trusted platform. Check one of the top rated ones available, you can check them here and get your score ready within 90 seconds.

With the proliferation of online tools and services, it’s essential to pick a source that ensures the security of your personal information. Look for platforms with a track record of safeguarding user data and providing accurate credit information.

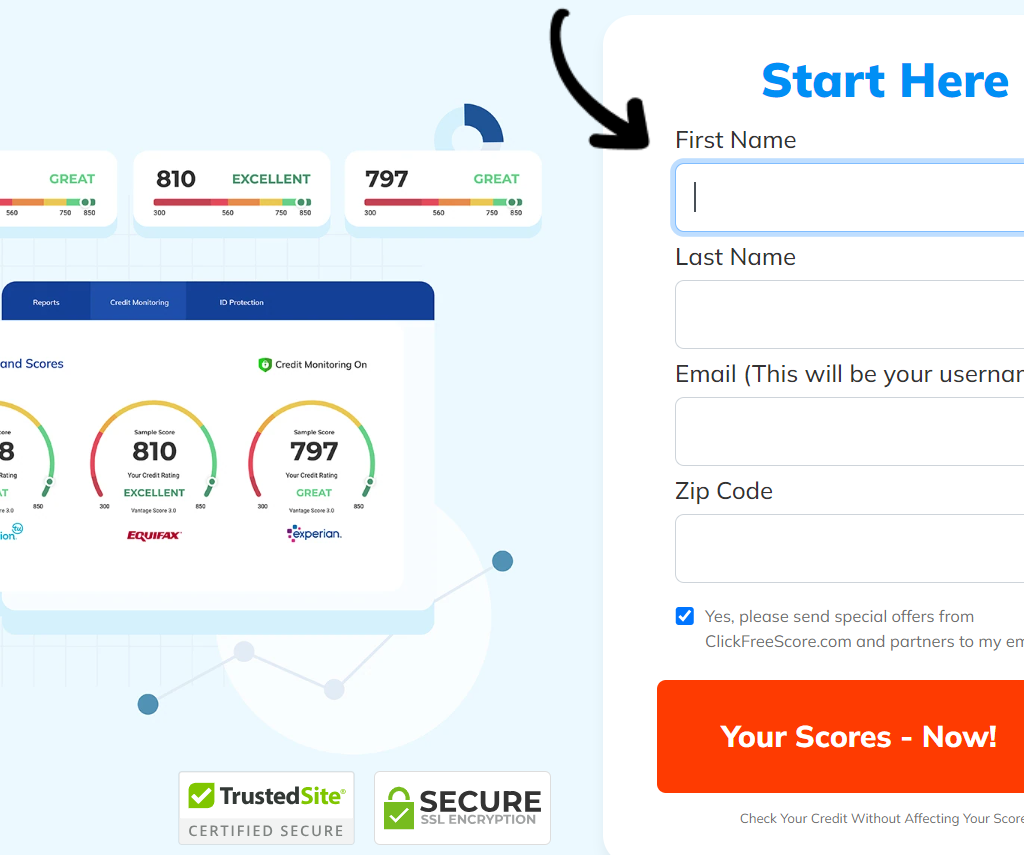

Step 2: Provide Basic Information

Once you’ve chosen a platform, you’ll need to provide some basic information to confirm your identity. This typically includes your name, date of birth, social security number, and possibly some additional identifying details. Rest assured that reputable platforms use encryption and other security measures to keep your information safe.

Step 3: Access Your Scores and Reports

After confirming your identity, the platform will swiftly gather your credit scores and credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. This comprehensive view gives you a holistic understanding of your credit standing. In a matter of seconds, you’ll have access to valuable insights about your credit utilization, payment history, and more.

Step 4: Review and Understand

With your credit scores and reports in hand, take a moment to review each one carefully. Understand the factors that contribute to your scores and identify any discrepancies or potential areas for improvement. A strong credit history opens doors to favorable interest rates and financial opportunities, so it’s worth investing a little time to grasp your current standing.

Why Checking Your 2023 Credit Scores Matters:

Staying informed about your credit scores has never been more important. Lenders use these scores to evaluate your creditworthiness, making decisions about lending and interest rates. Even potential employers and landlords might consider your credit history as an indicator of your reliability. By regularly checking your credit scores, you can catch errors, spot fraudulent activity, and take proactive steps to boost your scores.

Discover Your 2023 Credit Scores Today

Ready to take control of your financial future? Don’t wait any longer – access your 2023 credit scores and credit reports today in just 90 seconds. Head over to one of the best-rated websites here to get started. In a matter of minutes, you’ll gain a comprehensive view of your credit standing for 2023. Remember, your credit score is a powerful tool – make sure it’s working for you!

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making any financial decisions.